Events

2026 Global Annual Meeting

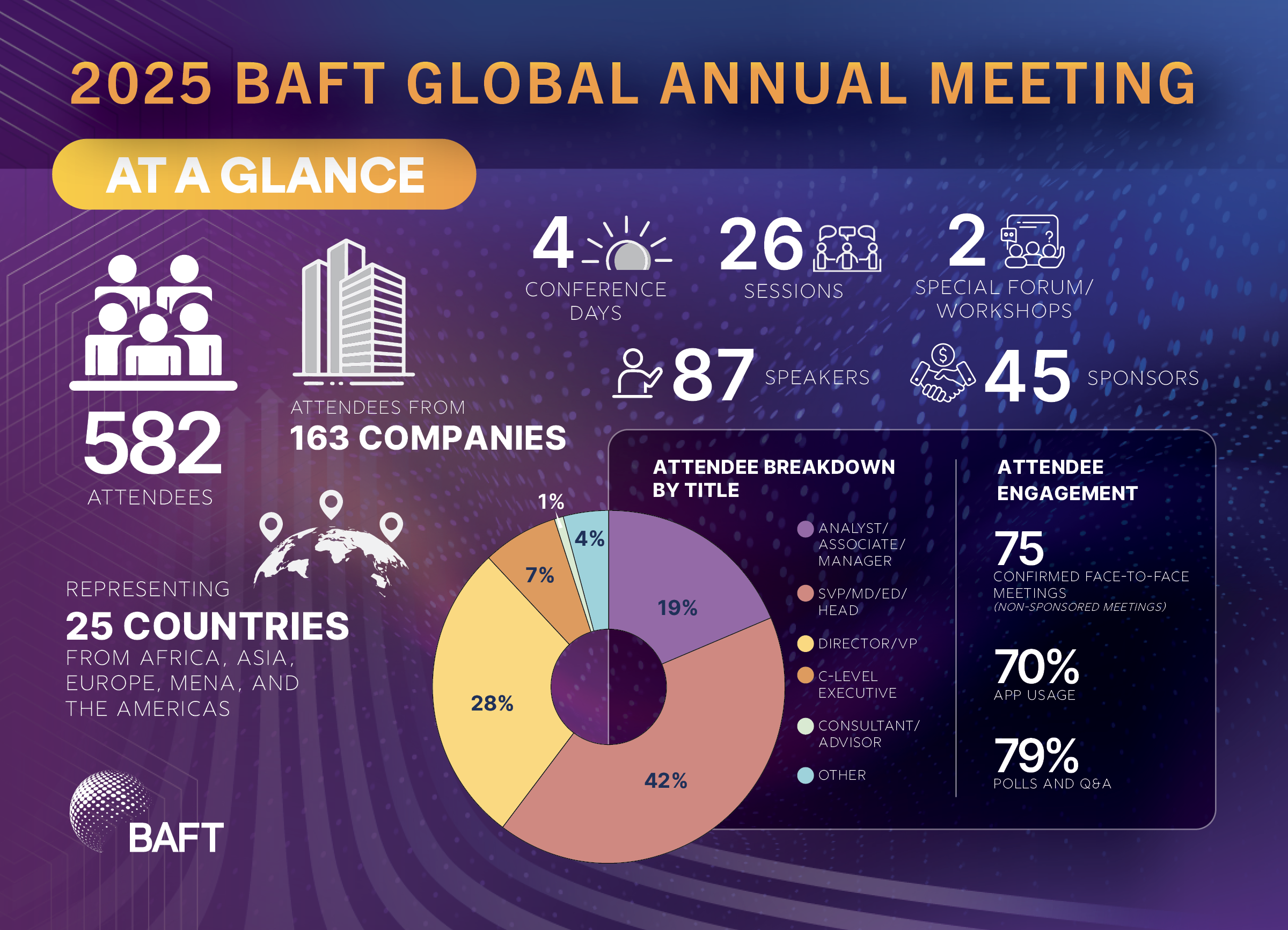

Following another record-setting 2025 conference, the BAFT Global Annual Meeting returns in 2026 for another flagship gathering of senior leaders across transaction banking, trade, and payments.

What to expect at this year’s conference:

- Four days of networking and bilateral meetings

- Three days of plenary sessions featuring respected industry leaders and thought-provoking speakers

- Three days of access to the BAFT Lounge, designed to make bilateral meetings convenient and efficient

- Two main conference receptions and social gatherings

- Access to the BAFT Events app to stay connected with fellow attendees and up to date on conference activities (BAFT Lounge reservations are managed through the app)

- 2026 Future Leaders Class presentation and graduation

- Golf is back! Remember to register as part of your conference registration.

Program

May 3, 2026 - Sunday

8:00 AM – 6:00 PM

Registration and Badge Collection

All attendees must have a badge to participate in bilateral meetings and the conference program.

9:00 AM – 6:00 PM

Bilateral Meetings

All attendees must have a badge to participate in bilateral meetings. Tha BAFT Lounge will be open during this time. Reserve your table via the BAFT Events app.

6:00 PM – 8:00 PM

Opening Night Welcome Reception

Sponsored by

May 4, 2026 - Monday

7:00 AM – 5:00 PM

Registration and Badge Collection

All attendees must have a badge to join bilateral meetings and conference program.

7:00 AM – 8:00 AM

Networking Breakfast

Sponsored by

8:00 AM – 12:30 PM

General Sessions

12:30 PM – 2:00 PM

Women in Transaction Banking Forum and Lunch

Sponsored by

12:30 PM – evening

Bilateral Meetings

All attendees must have a badge to participate in bilateral meetings. Tha BAFT Lounge will be open until 6:00 PM. Reserve your table via the BAFT Events app.

May 5, 2026 - Tuesday

7:00 AM – 5:00 PM

Registration and Badge Collection

All attendees must have a badge to join bilateral meetings and conference program.

7:00 AM – 8:00 AM

Networking Breakfast

8:00 AM – 12:30 PM

General Sessions

12:30 PM – 2:00 PM

Keynote Speaker Luncheon

Sponsored by

12:30 PM – 6:00 PM

Bilateral Meetings

All attendees must have a badge to participate in bilateral meetings. Tha BAFT Lounge will be open during this time. Reserve your table via the BAFT Events app.

6:00 PM – 6:45 PM

Class of 2026 Future Leaders Graduation

6:45 PM – 8:00 PM

Evening Socials and Graduation Celebration

Join us for a networking event celebrating the graduation of the 2026 Future Leaders class, and connect with industry peers and fellow attendees in a comfortable and social setting.

May 6, 2026 - Wednesday

7:00 AM – 8:30 AM

Registration and Badge Collection

All attendees must have a badge to participate in bilateral meetings and the conference program.

7:30 AM – 8:30 AM

Networking Breakfast

8:30 AM – 12:30 PM

General Sessions

12:30 PM

Closing Remarks

Register

| Registration Type | Early Bird Rate (Until March 20, 2026) |

Regular Rate (From March 20, 2026 – April 17, 2026) |

Last Minute Rate (After April 17, 2026) |

| Member | $2,100 USD | $2,250 USD | $2,400 USD |

| Member Team | $1,900 USD | $2,050 USD | $2,200 USD |

| Non-Member | $2,900 USD | $3,050 USD | $3,200 USD |

*Team pricing is available exclusively to members registering six (6) or more at the full-conference rate from the same institution in a single transaction. Attendees with discounted or complimentary passes do not count towards the group minimum. To register your group, please contact [email protected].

Please Note:

You will be asked to log in to your BAFT web account to complete registration. If you have not reset your password or created a BAFT account, please complete this step before proceeding with your registration.

Speakers

Please check back once we finalize the sessions for the conference.

For those who submitted speaker proposals, confirmations will only be sent to those accepted and no later than the end of February.

FAQ's

Collaborate and showcase your expertise at the flagship event for Transaction Bankers

Join the leaders in the transaction banking community, along with others involved in cross border payments and trade, as we gather to discuss key issues and best practices at the 2026 BAFT Global Annual Meeting. The 2026 GAM is your opportunity to position your organization as a thought leader and connect with your clients. Plus, network with your colleagues or have uninterrupted meetings with prospective and future clients during dedicated bilateral meeting times included in the program schedule.

Premier Levels

Benefits |

Platinum |

Gold $26,000 (1 available) |

Silver |

Bronze |

| Thought Leadership | ||||

| Speaking opportunity in event programming | Yes (Plenary Session) | Yes (Plenary Session) | Yes (Yes, spotlight stage session) | |

| One-page flyer for conference registration desk | Yes | Yes | Yes | Yes |

|

Event Registrations and Lead Generation |

||||

| Complimentary registrations | 6 comp registrations | 4 comp registrations |

3 comp registrations | 2 comp registrations |

| Bilateral meeting space | Yes | Yes | Additional $2500 |

Additional $4500 |

| Event Attendee List with Email Contact Information (pre- and post-event) | Yes | Yes | Yes | Yes |

|

Marketing and Branding |

||||

| Custom giveaway to all attendees | Yes | – | – | – |

| Table-top display | Yes | Yes | Yes | Additional $2500 |

| Pull-up banner in registration area for the duration of conference | Yes | Yes | Yes | Yes |

| Logo featured on event website and on-site marketing materials | Yes | Yes | Yes | Yes |

| Recognition as sponsor during event introduction and event PPT presentation | Yes | Yes | Yes | Yes |

| Logo included on all email promotion pre- and post-event | Yes | Yes | Yes | Yes |

PLATINUM SPONSOR – 1 Available (Deutsche Bank, Swift, Visa)

- Recognition as a Platinum Sponsor with speaking opportunity in the plenary conference program*

- 6 complimentary conference registrations

- Premium bilateral meeting space

- Custom branded giveaway item to attendees (sponsor provides giveaway)

- Table-top display (sponsor provides tablecloth, banner, etc.)

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Platinum Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

GOLD SPONSOR – 1 Available (ING, J.P. Morgan, LiquidX, RBC Capital Markets, SMBC, StoneX, TD Securities, Wells Fargo)

- Recognition as a Gold Sponsor with speaking opportunity in the plenary conference program*

- 4 complimentary conference registrations

- Bilateral meeting space

- Table-top display (sponsor provides tablecloth, banner, etc.)

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Gold Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event 4 BAFT.

SILVER SPONSOR – 2 Available (Cleareye, MYRIAD GT, US Bank)

- Recognition as a Silver Sponsor with a 25- minute thought leadership session on BAFT Spotlight Stage (sponsor provides topic and speaker(s) for session)

- 3 complimentary conference registrations

- Option to add bilateral meeting space for additional $2500

- Table-top display (sponsor provides tablecloth, banner, etc.)

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Silver Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

BRONZE SPONSOR – 5 Available (Bank of America, LBBW, Huntington)

- Recognition as a Bronze Sponsor

- 2 complimentary conference registrations

- Option to add bilateral meeting space for additional $4500

- Option to add table-top display for additional $2500 (sponsor provides tablecloth, banner, etc.)

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Bronze Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

Featured Events and Additional Sponsorship Opportunities

SUNDAY OPENING EVENING RECEPTION – SOLD OUT (Deutsche Bank)

- Sponsor provides welcome remarks for Opening Reception

- 5 complimentary conference registrations

- Bilateral meeting space

- Pull-up banner at sponsored reception and in registration area during duration of event (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Opening Reception Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion preand post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

TUESDAY EVENING RECEPTION – $25,000

- Sponsor provides welcome remarks for Tuesday Reception

- 4 complimentary conference registrations

- Bilateral meeting space

- Pull-up banner at sponsored reception and in registration area during duration of event (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Tuesday Reception Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion preand post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

TUESDAY CONFERENCE KEYNOTE LUNCH – SOLD OUT (PNC)

- Sponsor provides keynote speaker for Tuesday Lunch

- 2 complimentary conference registrations

Bilateral meeting space - Pull-up banner at sponsored lunch and in registration area during duration of event (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Tuesday Keynote Lunch Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

SUNDAY GOLF TOURNAMENT – $12,500

- 3 complimentary conference registrations

- 1 complimentary golf foursome

- Pull-up banner at Sunday Golf Tournament and in registration area during duration of event (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Sunday Golf Tournament Sponsor during event opening with opportunity for company representative to present trophy to winning team

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

NETWORKING BREAKFAST – $11,500 – 2 Available (Fifth Third)

- 3 complimentary conference registrations

- Pull-up banner at sponsored breakfast and in registration area during duration of event (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Networking Power Breakfast Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

COFFEE BREAKS – $6,500 – SOLD OUT (CBA, Credit Agricole, SmartTrade)

- 1 complimentary conference registration

- Pull-up banner at sponsored coffee break and in registration area during duration of event (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Coffee Break Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

CONFERENCE WIFI – SOLD OUT (StoneX)

- Sponsor customizes WiFi password and logo on program provided to all attendees

- 2 complimentary conference registrations

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as WiFi Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

CONFERENCE SLIDO Q&A AND POLLING – SOLD OUT (ING)

- Sponsor logo featured on Slido Q&A and Polling application

- 2 complimentary conference registrations

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Slido Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

NETWORKING LOUNGE SPONSOR – $9,500

- Recognition as Networking Lounge Sponsor with dedicated table for meetings

- 2 complimentary conference registrations

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Networking Lounge Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion preand post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

CHARGING STATION – $8,500

- Sponsor branded charging station

- 1 complimentary conference registration

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

CONFERENCE NOTEPADS – $7,500

- Sponsor supplies logo notepads

- 1 complimentary conference registration

- One-page flyer/insert for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion preand post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

TABLE-TOP DISPLAY – $6,500 – 6 Available

- Table-top display (sponsor provides tablecloth, banner, etc.)

- 1 complimentary conference registration

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion preand post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

TABLE-TOP DISPLAY – $6,500 – 6 Available

- Table-top display (sponsor provides tablecloth, banner, etc.)

- 1 complimentary conference registration

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion preand post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

CONFERENCE BAGS – SOLD OUT (J.P. Morgan)

- Sponsor provides logo bags for attendees

- 1 complimentary conference registration

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and on-site marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

MOBILE APPLICATION – $6,500

- Sponsor logo featured on banner on mobile app homepage

- 1 complimentary conference registration

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

THOUGHT LEADERSHIP SESSION – $6,500 – 4 Available

- 25-minute speaking opportunity on the BAFT Spotlight Stage (sponsor provides topic and speaker(s) for session)

- 1 complimentary conference registration

- Pull-up banner in registration area (sponsor provides banner)

- One-page flyer for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event PowerPoint slide

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

BILATERAL MEETING SPACE – $6,500 – 4 Available (ANZ)

- Bilateral meeting space

- 1 complimentary conference registration

- Pull-up banner outside meeting space (sponsor provides banner)

- One-page flyer/insert for conference registration desk

- Recognition as Sponsor during event opening and logo displayed on event

- Logo included on conference website, all email promotion pre- and post-event, and onsite marketing materials

- Registration list with contact details (name, company, title, email) pre- and post-event

When will the BAFT Events app be available?

The app will be open shortly after the early bird deadline, about 4-5 weeks before the conference starts. An email will be sent once the app is open.

How do I access the BAFT Events App?

Download the app from Google Play or Apple App Store. Search for BAFT Events. Once you download the app, click on 2026 BAFT Global Annual Meeting. Enter your first/last name and the email used to register for the conference. A verification code will be sent to your email address shortly to access the conference app.

My institution restricts downloading apps to my work phone or computer. How can I use the app/event platform?

You can use the web version instead of the event app. Go to https://cvent.me/arAWOv. A verification code will be sent to the email you used at registration.

I didn’t receive my verification code. Who do I contact?

Your verification code is sent to the email address you used when you registered for the conference. If you didn’t receive your code, please check your spam folder. If you still don’t see your verification code email, please contact [email protected] or stop by the BAFT registration table in the foyer of the Grand Ballroom.

How do I schedule meeting appointments via the app?

- Click the Schedule bilateral meetings from the app or website homepage

- Search the attendee name you want to meet with

- Click the calendar icon to the right (if using the web version) or below the attendee name (if using the app)

- Select the appointment time and add any additional details, then send the meeting invitation.

Who can schedule bilateral meeting appointments via the app?

The BAFT Lounge is only available to attendees that DO NOT have private bilateral meeting spaces.

Watch the short tutorial

How do I reserve a table at the BAFT Networking Lounge? When your meeting invitation is accepted, a table will automatically be assigned to you. Please check in at the Penn Avenue Terrace on the Lobby Level about 5 minutes before your meeting starts. Table reservations are up to 30 minutes long. Please be mindful of your fellow attendees and end your meetings on time for others to use your table.

How many meeting attendees can I invite to the BAFT Lounge?

Table reservations are available for up to 10 attendees (including the meeting host) at a time. Please see the maximum capacity per table available to reserve. The app will automatically assign a table based on availability and number of meeting attendees.

How do I know if my meeting is accepted?

You will receive a notification when your meeting invite is accepted, and the meeting will display with your table assignment under My Schedule.

How does an attendee get notified of a meeting request?

The attendee will receive a notification via the app. Please make sure to accept notifications when you first sign in to the app.

The BAFT Global Annual Meeting is occurring at the Hyatt Regency Grand Cypress Resort

Hyatt Regency Grand Cypress Resort

One Grand Cypress Blvd

Orlando, FL 32836

(407) 239-1234

To Book Your Hotel Room

BAFT has secured a special block of rooms exclusively for conference attendees at a discounted rate. Upon completing your conference registration, your confirmation email will include a link to book your hotel room. Please make sure to book your room immediately, as these rooms often sell out before the hotel booking deadline

Testimonials

“Conference was well attended, with several senior members from the transaction banking industry present. The level of the conferences and panels was great, providing good insights on today's transaction banking main issues”

“Best BAFT I've ever attended. Massive attendance, great discussion. Even better presentations.”

“Networking ability is top notch and ability to see so many of my relevant clients in 1 place at 1 time is invaluable.”

“Good way of gaining knowledge and interacting with our banking partners in a formal and informal way.”

“A large diverse network of banks attending, good sessions, and bilateral time.”

“It was a good balance of sessions on current topics that are useful to me along with bi-lateral meetings.”

“This was my first BAFT GAM experience and I thought all the plenary sessions were informative and relevant. It seemed to strike a good balance with all of the bilateral meetings.”

“Perfect and efficient event to meet clients and exchange current banking practices.”